14

Mar

Samsung graduates from disruptor to mature 5G leader

MWC 2023 turned out to be a graduation party for Samsung Networks, from a market disruptor to a mature, reliable and confident 5G infrastructure leader. This was evident from the flurry of announcements made around the event, including its own, as well as from operators and other ecosystem partners.

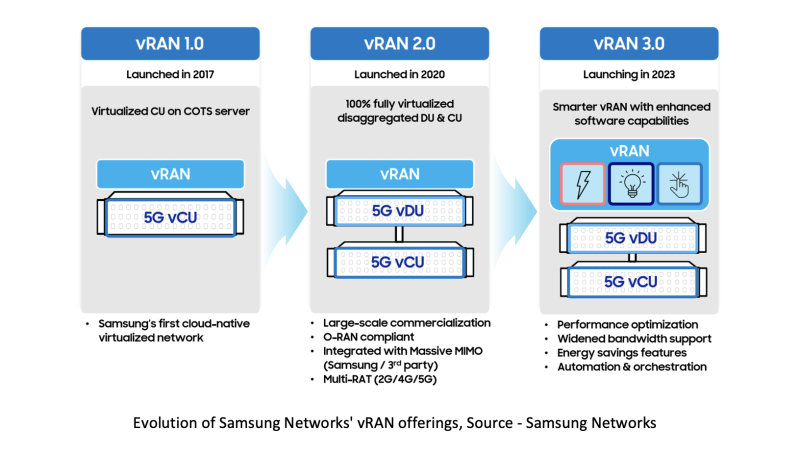

The announcement season actually started late last year when DellOro Group crowned Samsung Networks the vRAN/open RAN market leader. To top that, during MWC, Samsung Networks announced its next-gen vRAN 3.0, as well as many collaborations and partnerships.

To my credit, Samsung Networks followed the trajectory I outlined in this article in 2021. It has meticulously built and expanded its global footprint and created a sizeable ecosystem of partners that are technology and market leaders in their respective domains.

Next-gen infrastructure solutions

Unlike other large infrastructure vendors such as Ericsson, Huawei and Nokia, Samsung was an early and enthusiastic adopter of vRAN/open RAN architecture. Being a challenger and a disrupter made that decision easy — it didn’t have any sacred cows to sacrifice, i.e., legacy contracts and relationships. That gave it a considerable head start that it continues to maintain.

The vRAN/open RAN transition is shaping up to be a two-step process: First, a disaggregated, cloud-native, single vendor, fully virtualized RAN (vRAN), with open interfaces, followed by a multi-vendor truly open RAN. Many of Samsung Network’s competitors are still on the first step, deploying their first commercial base stations. In contrast, Samsung Networks has already moved on to the second step (more on this later).

Samsung Networks announced its next-gen solutions, dubbed vRAN 3.0, which brings many performance optimizations and significant power savings. The former brings a key feature that supports up to 200 MHz of bandwidth with 64T64R massive MIMO configuration. That almost entirely covers the mid-band spectrum of U.S. operators. The latter involves optimizing usage and sleep cycles of CPU cores to match user traffic, thereby minimizing power consumption. These software-only features (with the proper hardware provisioning) exemplify the benefits of a disaggregated vRAN approach, where the new capabilities can be rapidly developed and deployed.

Also, part of vRAN 3.0 is the Samsung Cloud Orchestrator. It streamlines the onboarding, deployment and operation processes, making it easier for operators to manage thousands of cell sites from a unified platform.

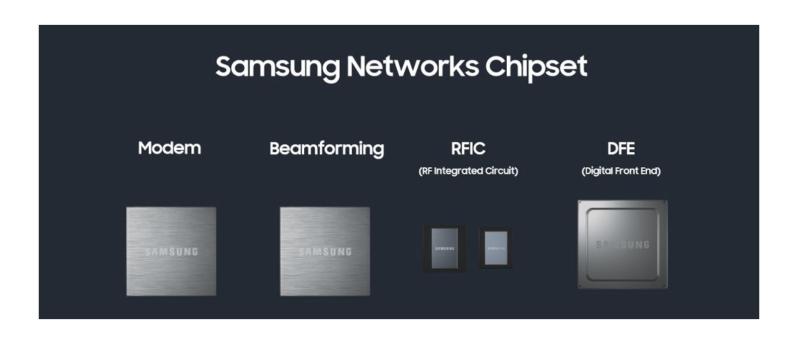

Although large parts of vRAN/open RAN are software-defined, the key radio technologies still reside in hardware. That is where Samsung Networks has a strong differentiation. It is the only major network vendor that can design, develop and manufacture 4G and 5G network chipsets in-house.

0 comments